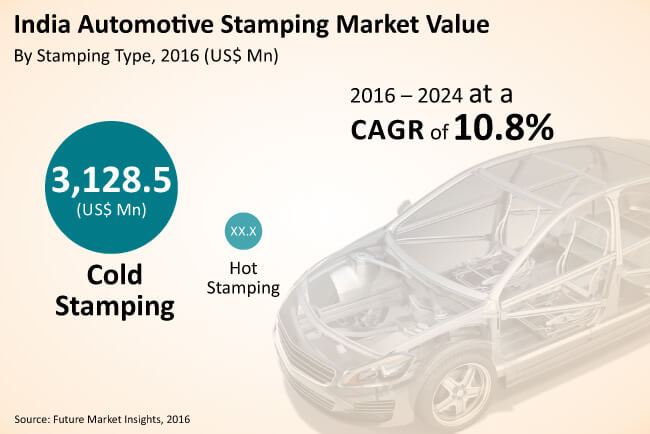

Cold stamping segment is expected to hold dominant market share throughout the forecast period

In terms of value, the hot stamping segment is expected to gain more than 100 BPS over the forecast period. Being at the initial stages of adoption in India, this segment is projected to expand at a CAGR of 11.5% over the forecast period. Hot stamping segment is anticipated to witness increased adoption over the forecast period, particularly for body stamped components. The hot stamping segment in the India automotive stamping market is estimated to be valued at more than US$ 650 Mn in 2017 and is expected to represent incremental $ opportunity of more than US$ 1000 Mn between 2016 and 2026. The cold stamping segment is expected to lose a little more than 115 BPS during the anticipated period. However, it is also expected to expand at a CAGR of 10.6% over the estimated period. The cold stamping segment of the India automotive stamping market is predicted to be valued in excess of US$ 3400 Mn in 2017 and is expected to represent incremental $ opportunity of more than US$ 5000 Mn between 2016 and 2026. This segment is slated to be valued at more than US$ 8000 Mn by 2026.

Robust increase in the production of four wheelers anticipated to fuel the growth of the stamping segment in the India automotive stamping market

India has been experiencing a robust increase in four wheeler production and marginal growth in two and three wheeler production – this has been the country’s answer to the increasing demand from domestic and international markets. The demand for cold and hot stamping is directly proportional to the production of vehicles and demand from the aftermarket is comparatively less. The growth of automotive sales in India is indirectly creating robust development in the hot and cold stamping segments and this trend is projected to continue during the forecasted period.

Ask For Report Sample@ http://www.futuremarketinsights.com/reports/sample/rep-in-3207

The automotive component industry holds significant value in the stamping segment. The industry outperformed even during the global economic recession. India is rapidly emerging as a sourcing hub for automotive components such as engine and transmission parts. This increase in export demand for automotive components will compel OEMs and Tier 1 manufacturers to manage their production capacity by establishing new outfits for stamping automotive components. This is likely to boost the growth of the cold and hot stamping segments in the India automotive stamping market. The various initiatives taken by the Indian government as well as the automotive industry to make India a world-class automotive hub will attract significant investment in the domestic manufacturing sector by OEMs; which in turn, will lead to increase in demand for stamping facilities, thereby driving the growth of the hot and cold stamping segments.

It is observed that there is a growing preference for the hot stamping process in the India automotive stamping market as it enables manufacturing of lightweight automotive components with higher strength. It is a cost-effective technology used to manufacture complex parts without many pressing issues. The hot stamping process has high penetration in North America, Europe and China. However, significant investments made by some of the leading players in the market towards hot stamping are expected to draw the attention of other manufacturers towards this technology.

Ask For More Information@ http://www.futuremarketinsights.com/askus/rep-in-3207

Restricted pricing flexibility likely to hamper the growth of the stamping segment in the India automotive stamping market

Over the past decade, weight reduction and performance improvement have been the prime focus of automakers in the Indian automobile industry. However, these two sets of attributes can only be achieved through the use of advanced materials that are costlier than the existing ones. These days, manufacturers are focussing on reducing manufacturing costs. These factors when combined with the existent intense competition present in the domestic automotive stamping market create significant pressure on manufacturers to reduce their margins. The restricted pricing flexibility in the India automotive stamping market might act as a barrier for new entrants in the market.

The Indian automotive industry includes a large number of Tier II and Tier III players involved in the production of sheet metal components and assemblies. Unlike the large OEMs and Tier I players who have large capital to invest, Tier II and Tier III players are reluctant to invest in new products and technologies due to the high costs. Furthermore, the complexity of operations of newly imported equipment is another factor that might restrain existing players in the market and stop them from adopting new technologies. This, in turn, can act as a deterrent to the growth of the stamping segment in the India automotive stamping market.

Find More Information@ http://www.futuremarketinsights.com/reports/india-automotive-stamping-market