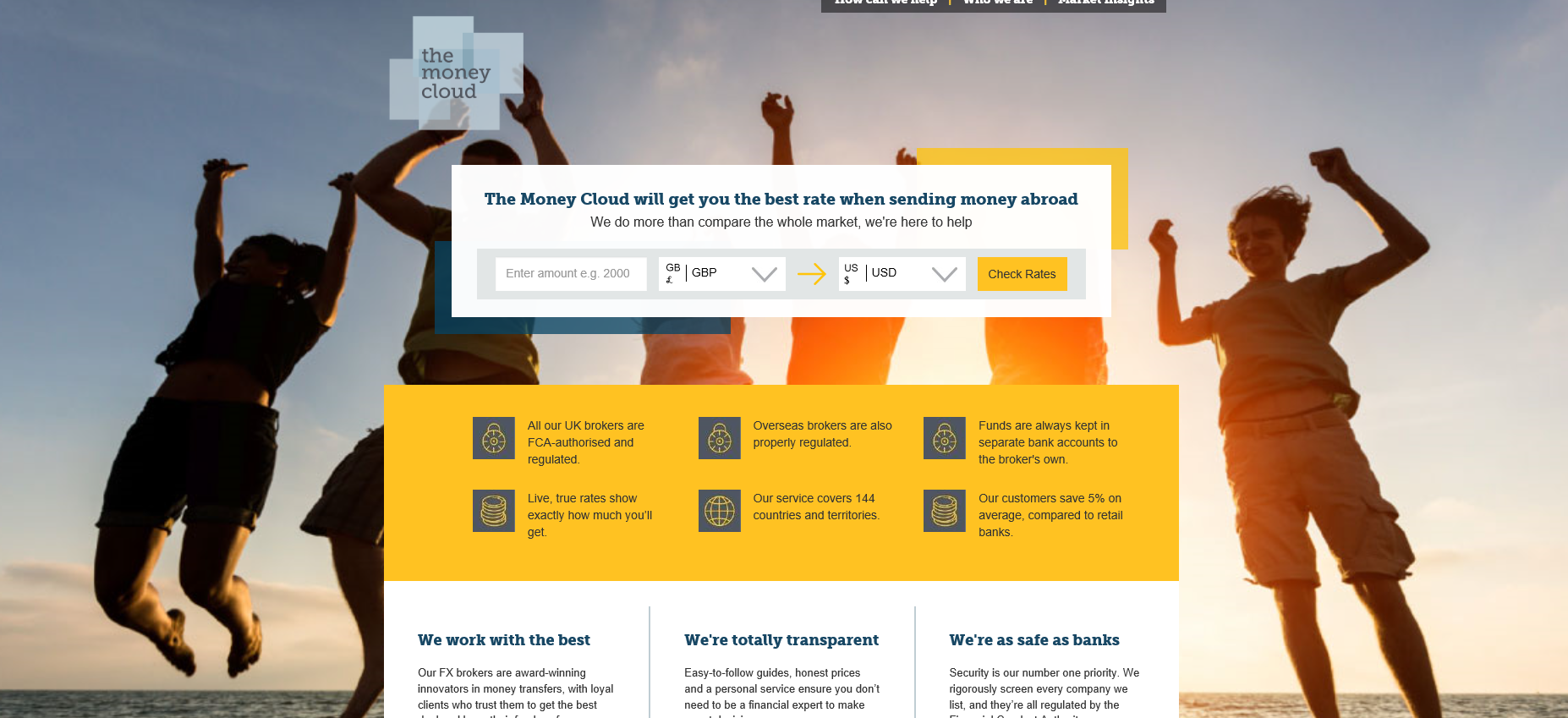

5th May 2015. Today sees the launch of The Money Cloud, a pioneering international money transfer site that’s set to revolutionise the way consumers send money overseas.

More information: The Money Cloud

The Money Cloud is the brainchild of Huw Jenkins and Emmanuel Addy, who invented international money transfer comparison over a decade ago. Their latest venture uses intelligent algorithms to show customers the best deals on the market from foreign exchange brokers and banks, giving them far more power and knowledge than ever before.

Transparency is at the heart of The Money Cloud. Its search listings display live, true exchange rates from brokers and banks. It doesn’t show the rates banks will only give each other, which is what’s usually advertised. Listings also include user ratings, unbiased reviews, safety measures, transfer timescales and accurate quotes. Put in what you need, find out exactly what you’ll get.

Huw Jenkins, co-founder of The Money Cloud, commented: “The world of financial currency exchange is increasingly complex, so we created a product that gets rid of complication and gives consumers and small businesses a much more simple approach.

We designed The Money Cloud for today’s global consumer with a focus on currency rather than geographical location. Our offer is born out of recognition that in today’s global economy, a Canadian business might need to transfer Thai baht, and a London-based lawyer may want to send US dollars.”

The Money Cloud also publishes regular blogs and no-nonsense guides to help customers make their own smart financial decisions. These distil complex jargon into easy-to-follow, relatable information, on topics from payment technology to how to make the most of your international money transfers.